This week is all about YNAB and why it’s changing lives.

My friend Genie Leslie is lending her voice to Finance Misfits this week to discuss why she loves the budgeting software You Need A Budget. She makes a compelling case - if I didn’t already use it, I’d probably be convinced.

This is absolutely not a paid post - we just both really like YNAB (YNAB editors, hit our DMs, if you want to work something out)

I’d be an absolute fool not to include this, so if you read through this and decide you want to give the YNAB system a try, you automatically get 34 days free, and if you use my link, you can get a free month if you decide to buy a subscription.

Obligatory statement to say that we aren’t qualified to give financial advice. These are our experiences - you should go have your own!

Budgeting Without Guilt: Why I Use YNAB

By Genie Leslie @genieleslie

Guilt and money seem to go hand-in-hand in our world. We feel bad buying the expensive dress just because we want it. We brag about the thrift store pants that cost 25 cents. We put off a vacation, or a new computer, or even just those nice candles we’ve been eyeing because it feels selfish. Guilt is everywhere. So the most life-changing, impactful personal finance tip I’ve learned is not about retirement accounts or managing credit cards or saving an emergency fund (though those are all quite good). It’s to manage my money so that I can spend what I want, when I want, without guilt. And that’s all thanks to YNAB.

You Need a Budget, affectionately known as YNAB to budgeting nerds like myself, is my budgeting system of choice. I’m annoying about it. I’ve helped friends and coworkers set up their budgets and start using the system simply because it’s fun for me. I got my sister to try it and write a whole blog series with me about it.

For those who don’t know, YNAB is a system, not just a budgeting app, with rules (and your girl here loves rules).

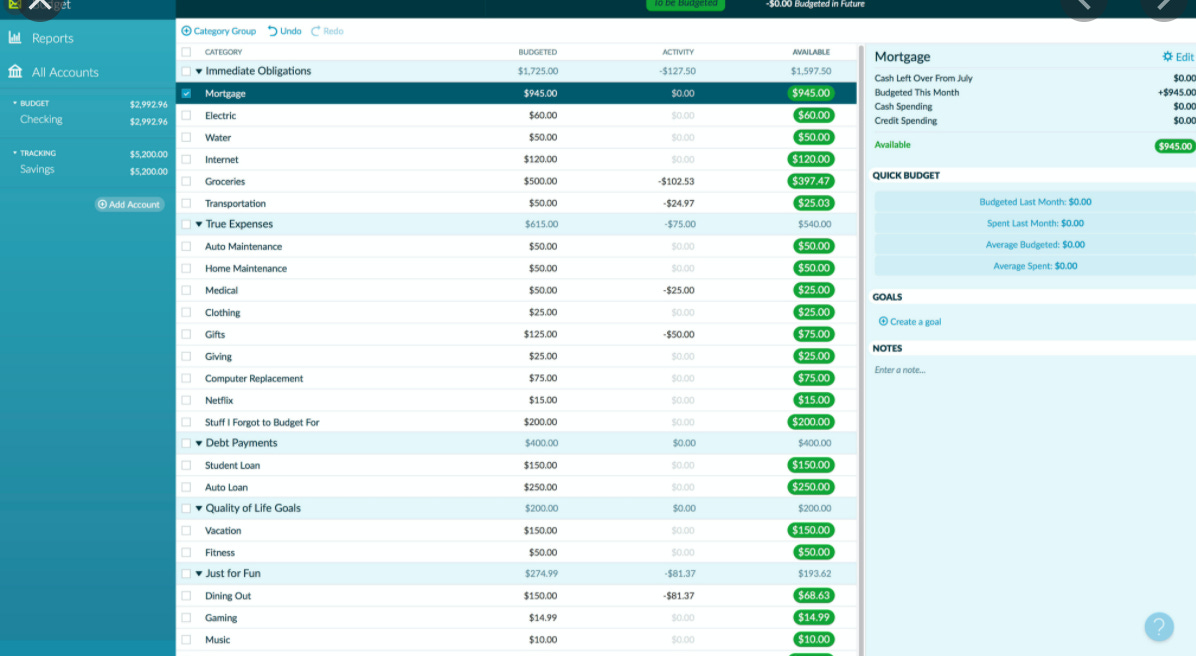

Give Every Dollar A Job: Don’t budget based on estimates, don’t budget more than you have, and don’t leave any dollar unspoken for. If you have $1200, budget each one toward something. This was huge when I had freelance variable income—I had to budget what I had and only what I had, and prioritize where my money went depending on the time of the month.

Embrace Your True Expenses: Groceries and monthly bills aren’t your only expenses, and your budget shouldn’t pretend they are. Set money aside every month for that annual car insurance bill, or the possibility of medical expenses, or in preparation for Christmas gifts. You do know these things will happen, even if you don’t always know when.

Roll With The Punches: My favorite rule. This one is about flexibility. If you overspend in one place, no big deal! Just move some money from another category to cover it. Your budget doesn’t have to be, and actually shouldn’t be, rigid and unchanging. As long as you’re still giving every dollar a job and not overspending all the dollars, it’s fine. And over time, you’ll learn where your spending priorities are and will fund those categories accordingly.

Age Your Money: This one wasn’t even on my radar before YNAB. Building up a cushion. Planning ahead enough that you have a safety net. Right now in my YNAB budget, our money is “aged” 68 days. That means we could cover, right now, 68 days worth of expenses. If I lose my job tomorrow, we’d be financially okay through February, at least. This happens because, after a while of giving every dollar a job, you start to put any unspoken dollars into the next month’s budget. And then the next month’s.

I could go on longer about how YNAB specifically changed how I managed credit cards and debt, but these rules really are the core to it all. Putting them in place (with or without the actual YNAB apps* doing the math for you) can completely change your mindset and the way you think about money. I don’t check my bank balance anymore, I just check my budget. When a big annual bill arrives, like the ~$400 car tabs we just got, it’s not a panic-inducing moment because I’ve been building that category up for a year in preparation.

And when I’m ready to spend money on a desk and a bookcase for my writing nook, or decorations to set the writing mood, I don’t feel bad or wonder if instead I should be putting that money toward something more “practical,” because I’ve built my budget around my priorities and building a comfortable writing space is a priority for me. I planned for it, I put the money aside, and now I’m damn well gonna spend it.

*Quick footnote about the apps: the YNAB apps do the math for you, connect to your bank accounts, and generally make life easier. I love them. But they do cost a subscription fee to use. The current price is $12/month or $84 if you pay for the whole year at once. That may or may not be too steep a price for many people. So I say, explore their website and learn about their system first. They have a huge catalog of free educational webinars, guides, and content. And they offer a 34-day free trial, so you can experience a full month of testing it out before paying for anything. I find a lot of value in changing my mindset about money so I don’t mind the expense, but even if you don’t pay for their apps, I promise you’ll find something worth learning about taking control of your money.

Book Review

If you’re not sold on You Need A Budget yet, then keep reading, because we’re just getting started.

The YNAB book is a good introduction to how the whole system works. It reads a little bit like a series of Pinterest posts, but it’s certainly easy to follow. It’s broken up into chapters for each of the four rules, plus sections about talking to your partner about money, saving for your kid’s college expenses, and getting (& staying) out of debt.

One of the things I like about the YNAB philosophy is that it is extremely forgiving. Not only is it flexible, as Genie mentioned, but it also doesn’t care what you’ve done in the past. If you’re starting your budget with tons of debt, or maybe you’ve overspent the past few months, YNAB does not care. All YNAB needs to know is how much you have right now, and where you want those dollars to go - the rest of it doesn’t matter. It’s like that Backstreet Boys song: "I don’t care who you are, where you’re from, what you did, as long as you [give every dollar a job]”

Like Genie mentioned above, the whole system is helpful for taking true control over finances. Even if the whole YNAB budgeting system isn’t for you, I think the book is worth a read. I truly believe the more financial techniques you expose yourself to, the better choices you’re able to make, and the more likely you’ll find what works for you.

I was able to download YNAB as an eBook from the library, and I’d bet dollars to donuts, you’ll be able to find a free copy that way as well.

Edit 2022: Here is a link where you can buy the book. As an Amazon Associate I earn from qualifying purchases.

News Brief

I had drafted a brief about the $600 Stimulus Package, but congress can’t get their collective heads out of their asses, so now I have nothing for you. Just like Congress and the American People.

Quote

“The simplest definition of a budget is "telling your money where to go.”

― Tsh Oxenreider